Namibia offers a tax framework that balances attracting foreign investment with ensuring sustainable revenue for the country. With recent amendments to corporate tax rates and a supportive investment environment, Namibia is positioning itself as a competitive destination for businesses in the Southern African region. This article explores Namibia’s taxation system in detail, comparing it to neighboring countries and highlighting its unique advantages.

Namibia’s Tax Framework: Recent Developments

Namibia’s tax system, managed by the Namibia Revenue Agency (NamRA), has seen significant updates aimed at fostering a competitive investment climate:

1. Corporate Income Tax (CIT):

• Effective 1 January 2024, the CIT rate was reduced to 31%, down from the previous 32%.

• A further reduction to 30% will take effect for companies with financial years commencing on or after 1 January 2025.

(source)

2. Value-Added Tax (VAT):

• The VAT rate remains at 15%, consistent with most countries in the region.

3. Withholding Taxes:

• Dividends, interest, royalties, and management fees to non-residents are taxed at 10%.

4. Mining Tax Rates:

• Non-diamond mining: 37.5%.

• Diamond mining: 55%.

5. Incentives for Manufacturers and Exporters:

• Reduced CIT rate of 18% continues for qualifying businesses in manufacturing and export.

6. Customs and Excise Duties:

• As a member of the Southern African Customs Union (SACU), Namibia applies uniform tariffs within the region.

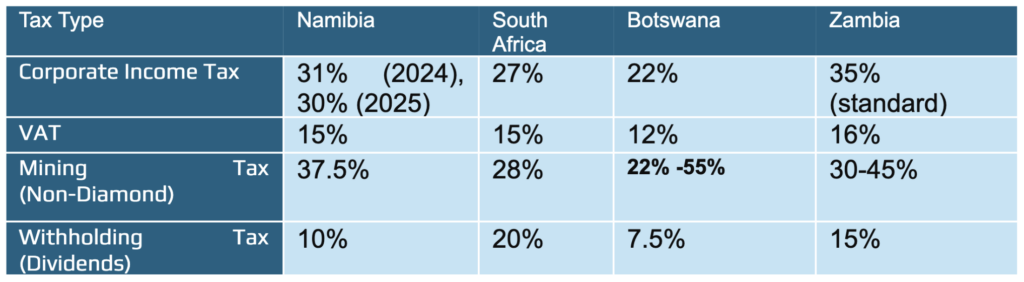

Comparing Namibia’s Tax Rates with Regional Counterparts

Tax Incentives in Namibia

Namibia’s government provides various incentives to attract investment, particularly in key sectors like manufacturing, renewable energy, and logistics:

1. Export Processing Zones (EPZs):

• EPZ companies are exempt from corporate income tax, VAT, and customs duties.

• Designed for export-oriented industries but being phased out in favor of SEZs.

2. Special Economic Zones (SEZs):

• The SEZ framework introduces tax holidays, reduced tax rates, and customs exemptions to replace EPZs.

3. Manufacturing and Export Incentives:

• Qualifying manufacturers benefit from the reduced CIT rate of 18%.

• Accelerated capital allowances for machinery and industrial buildings.

4. Double Taxation Agreements (DTAs):

• Namibia has DTAs with countries like South Africa, Germany, and Mauritius to prevent double taxation.

Regional Context: Namibia’s Competitive Edge

1. Strategic Location:

• Namibia’s access to the Port of Walvis Bay and trade partnerships through SACU and SADC make it a logistics hub for Southern Africa.

2. Stable Investment Environment:

• Namibia offers political stability, a transparent legal system, and a reliable financial sector.

3. Ease of Repatriation:

• Liberal foreign exchange policies allow investors to repatriate profits and dividends freely.

Challenges and Considerations

While Namibia’s tax framework is competitive, businesses must navigate:

1. Administrative Processes:

• VAT refunds and regulatory clearances can experience delays.

2. Evolving Tax Incentives:

• Transitioning from EPZs to SEZs may impact some tax benefits.

3. Mining Taxation:

• High tax rates in the mining sector require careful planning for profitability.

How Windhoek Accounting & Taxation Can Assist

Navigating Namibia’s tax environment requires expert knowledge and strategic planning. At Windhoek Accounting & Taxation, we provide:

• Tax Advisory Services: Tailored strategies to optimize tax benefits.

• Business Setup Assistance: Streamlined registration and compliance with local laws.

• Financial Management: Comprehensive accounting and reporting services.

• Cross-Border Expertise: Guidance on leveraging DTAs and navigating SACU regulations.

Conclusion

Namibia’s tax reforms, coupled with its strategic location and stable economy, create a compelling environment for investors. By staying informed about recent changes and leveraging available incentives, businesses can thrive in Namibia’s growing economy.

For personalized advice on navigating Namibia’s tax system and maximizing investment opportunities, contact Windhoek Accounting & Taxation today. Let us help you unlock the full potential of doing business in Namibia!