Establishing a bank account in Namibia is a critical step for non-Namibians looking to manage their personal finances or operate a business. Whether you are an individual planning to reside in Namibia or an entrepreneur setting up a business, understanding the requirements and processes is essential for a smooth transition.

1. Personal Bank Account for Non-Namibians

Opening a personal bank account in Namibia as a non-resident is straightforward, provided you meet the requirements of local financial institutions.

Requirements for a Personal Bank Account

1. Proof of Identity:

• A valid passport.

2. Proof of Address:

• A utility bill, rental agreement, or official correspondence confirming your residential address.

3. Visa or Work Permit:

• A valid visa or work permit demonstrating your legal status in Namibia.

4. Source of Funds:

• Documentation to verify your income source, such as a payslip, employment contract, or bank statement from your home country.

5. Initial Deposit:

• Some banks may require an initial deposit to activate the account.

Steps to Open a Personal Account

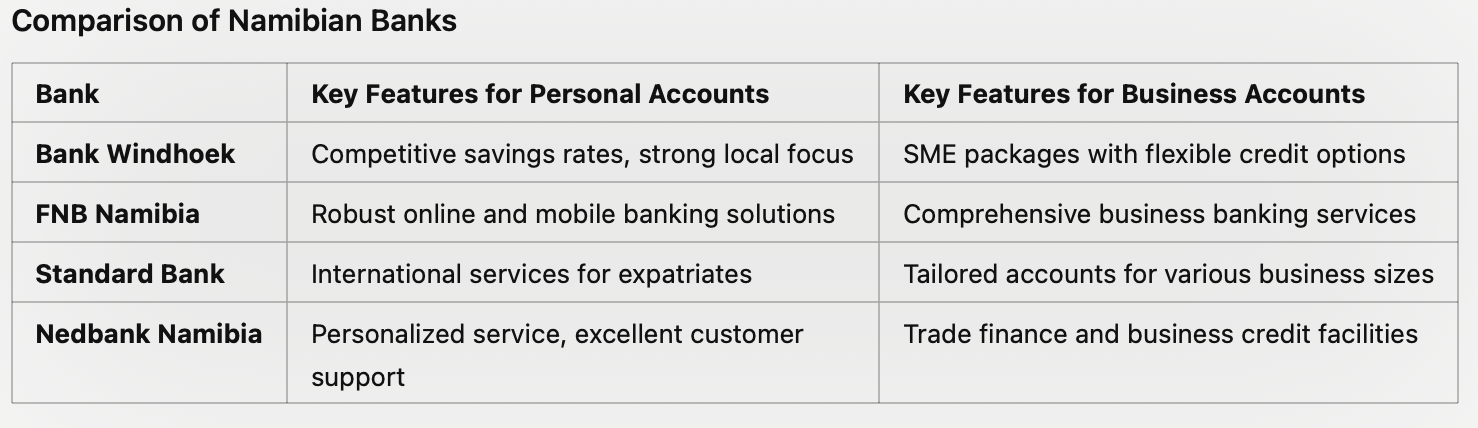

- Choose a Namibian bank (e.g., Bank Windhoek, FNB Namibia, Standard Bank, or Nedbank).

- Submit the required documents in person at a local branch.

- Wait for account verification, which may take a few days depending on the bank.

- Receive your account details, debit card, and online banking access upon approval.

2. Business Bank Account for Non-Namibians

Opening a business bank account is essential for managing corporate finances, facilitating transactions, and ensuring compliance with Namibian financial regulations.

Requirements for a Business Bank Account

1. Company Registration Documents:

• Certificate of Incorporation from Business and Intellectual Property Authority (BIPA).

• Memorandum and Articles of Association.

2. Tax Registration Certificate:

• Issued by the Namibia Revenue Agency (NAMRA).

3. Proof of Identity:

• Passports for all directors and authorized signatories.

4. Proof of Address:

• Utility bills or rental agreements for directors or business premises.

5. Work Permits or Visas:

• For foreign directors and shareholders.

6. Initial Deposit:

• Depending on the bank’s requirements.

7. Board Resolution:

• Authorizing the opening of the account and identifying signatories.

Steps to Open a Business Bank Account

- Register your business with BIPA and obtain a tax registration certificate from NAMRA.

- Choose a bank and gather the required documents.

- Submit your application in person or through a representative.

- Allow the bank to complete due diligence checks.

- Upon approval, receive your account details and banking tools such as checks or online banking credentials.

Considerations for Non-Namibians

• Foreign Exchange Controls:

- Namibia imposes some controls on the movement of funds in and out of the country. Ensure compliance with regulations for cross-border transactions.

• Compliance with Tax Laws:

- Register for tax compliance with NAMRA to avoid legal issues.

• Online Banking:

- Most banks in Namibia provide robust online banking platforms, enabling you to manage your account remotely.

How Windhoek Accounting & Taxation Can Help

Navigating the banking landscape in Namibia as a non-Namibian can be complex. At Windhoek Accounting & Taxation, we provide:

1. Guidance for Individuals:

• Assistance with opening personal accounts, ensuring compliance with local regulations.

2. Business Banking Support:

• Helping you gather and prepare all necessary documents for a business bank account.

3. Corporate Advisory:

• Ensuring your business meets BIPA and NAMRA requirements for smooth account opening.

4. Ongoing Compliance:

• Providing tax and financial advice to maintain regulatory compliance.

Conclusion

Opening a bank account in Namibia, whether personal or business, is a critical step for non-Namibians. By understanding the requirements and processes, you can ensure a hassle-free experience and focus on achieving your personal or business goals.

For expert guidance tailored to your needs, contact Windhoek Accounting & Taxation today. Let us help you navigate the complexities of Namibia’s banking system with ease.